In the modern world, the term " **blockchain** " is steadily associated with cryptocurrencies, NFTs, mining, trading and financial pyramids. However, even among programmers and IT people there is not always a clear understanding of what it is and what it is for.

This article attempts to look at this still relatively new element of the information and human space in practical and slightly philosophical aspects.

> **Disclaimer**: The article will use simple language to explain non-trivial concepts, so non-critical distortion of technical details is possible.

# The Problem of Authenticity

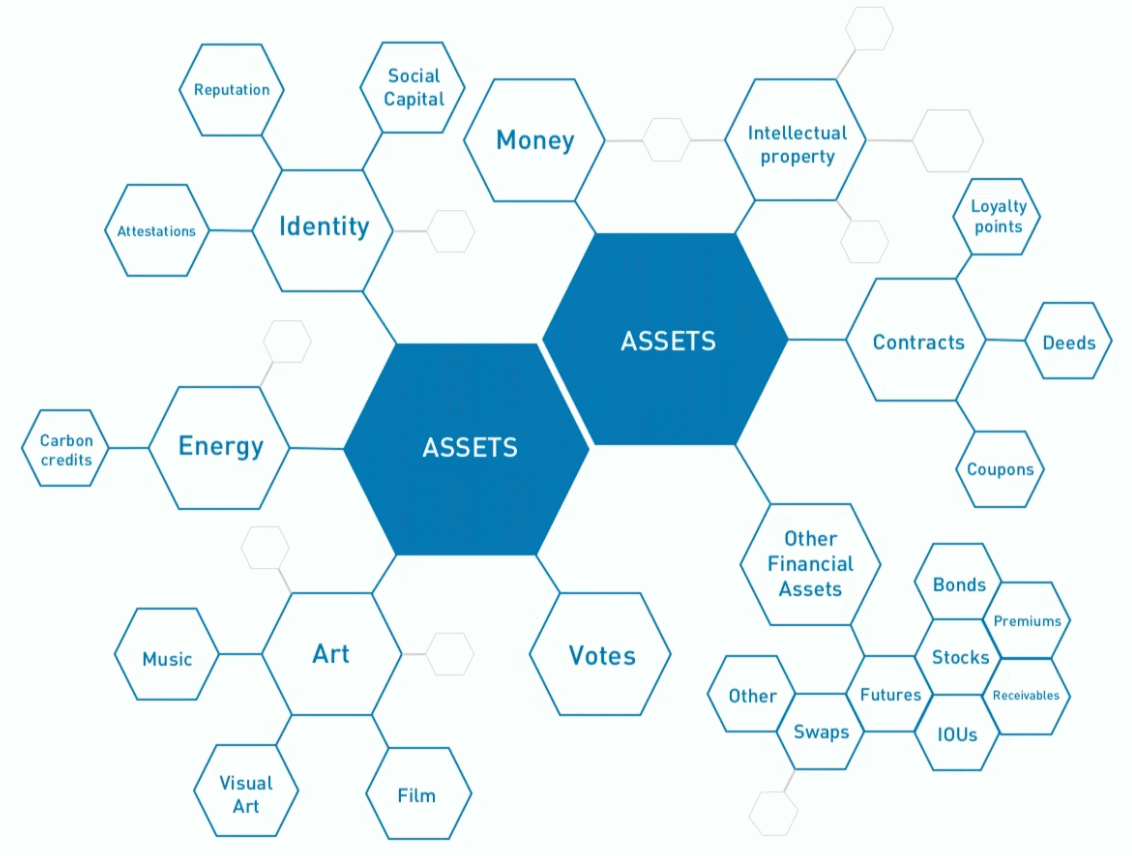

Some things can be easily copied — for example, a text file or a photograph on an electronic medium. Others can not, such as food. For some items, creating a duplicate degrades its very essence. Copying a hundred dollar bill a little devalues all the dollars in the world. And such objects, the essence of which is incompatible with unjustified reproduction, are not only money, but also many other human tangible and intangible assets — shares, certificates of land rights, intellectual property, bonus points, theater tickets, votes in elections, social capital, business reputation.

The presence in society of people who want to personally benefit from unauthorized copying of values raises the question of the need for a mechanism for managing these values, which would guarantee their authenticity and fair turnover.

## Fair Turnover

What does «fair turnover» mean?

Imagine that you change the currency on the street, and fake-money is slipped to you. Or you invest your savings in a business that turns out to be a pyramid scheme. Or your money in the bank disappears because the banker fled with all the bank money. Or your broker turned out to be a scammer. Or you «bought» a house, the real owner of which did not even know about the deal. Or all your money in your WebMoney e-wallet disappeared due to a power failure in their data center.

In all these cases, an external force intervenes in the fair circulation of assets - either an attacker, or some combination of circumstances. They have a loophole. They always do. Because no operation on these assets can be carried out as an atomic transaction, with the exception of the transfer/donation operation, which is of little interest. Usually there is an exchange of values. You give something to me, I give something to you. And this process consists of steps, between which a third party can intervene. I sell dollars, I give them to someone, and the third party kicks in. I put money on the stock exchange to buy stocks and the third party kicks in. I want to buy real estate in another country, I make a notarized power of attorney for an intermediary — and then those third parties simply stand in line.

## Guarantee

In order to somehow make such transactions more or less reliable, the concept of an escrow was introduced. This is a certain organization or individual that conducts this transaction and guarantees its fairness with its reputation. The parties to the transaction transfer their assets to the escrow (atomic operations), and he then distributes them according to the agreement concluded between them. An ordinary bank through which a person makes financial transactions is such an escrow. The government is an escrow. LinkedIn is an escrow. Old buddy Tom can be an escrow for certain yard dispute.

But, firstly, it is far from always possible to find an escrow for certain deals. Secondly, an escow is also subject to the influence of evil third-party forces. Both personally and through his computer system, for example. In a less degree affected, but not zero. And, thirdly, escrow services — risk minimization — are often very expensive.

The problem of middleman and escrow has always existed. This is a fundamental problem for economic and social relations in the world. This problem could not be solved even partially — neither in ordinary life, nor in the computer world. Until the blockchain technology appeared, which brought something qualitatively new, which was impossible before it. Namely, **a guarantee of fairness** in certain operations.

# Progress

Since the middle of the 20th century, information technology has developed quite predictably and systematically. First computers came. Then they began to be networked. Then additional protocols arose on top of those networks. For example, distributed computing networks — when one task that requires large computing resources is parallelized on several computers, which greatly speeds up its execution time. Or database replication — when the same data is duplicated on several physical servers in order to increase the reliability, performance and convenience for users of working with the database.

The work of any even very complex information system did not go beyond the algorithmic design of its creator. Each node of the system was responsible for something, occupying its own niche in the program's data flows. The developer or system administrator was for it a god who could do anything. For example, a Paypal developer could set the balance of his personal account to a couple of million dollars with a flick of the wrist. The same could be done by a hacker who got into the system. This is the problem of centralized systems. Systems with is centers that you can influence and get the desired result.

In 2008, someone named Satoshi Nakamoto introduced an innovative decentralized software architecture that made it very difficult for anyone to make such unauthorized changes to data.

## Bitcoin blockchain

He introduced the blockchain — a network of a large number of computers (thousands) that store information about:

1. Addresses of bitcoin wallets with their balance.

2. Transactions — operations of transferring a certain amount from one bitcoin wallet to another.

By design, once recorded in this registry data is unchanged. All information is available to everyone for viewing, and all of it is duplicated on each computer (node) of this network. All nodes are copies of each other. And this insane decentralized redundancy gives that dialectical transition of quantity into quality, which consists in the fact that it is almost impossible to unauthorizedly change once recorded data.

This protection is implemented in the following simple way. All incoming information about new addresses and transactions is recorded in parts — blocks. Every 10 minutes a new block is created from new transactions. After the formation of the next block, the hash of the previous block is added to it, and the hash of the current block is calculated, which is then used for the next block. It turns out such a chain of blocks, when each block refers to the previous one. As a result, when data in one block changes, its hash will change, which means that the hashes of subsequent blocks will become invalid. And that means the whole chain. Even if we recalculate and rewrite all subsequent blocks, we will get one node that is different from all the others. It simply will not be taken into account by the whole system.

When recording new transactions, the blockchain uses certain algorithms, a method of finding consensus between the nodes participating in the procedure. Specifically, the Bitcoin blockchain uses the «Proof of Work» method. It makes outside interference very difficult.

Theoretically, in order to have an impact on a decentralized blockchain, an attacker would need to interfere with the work of more than half of its nodes. Then he will be able to deceive the system and make «double bitcoin spending» — to send two transactions from one address at the same time and duplicate the transfer amount to both receiving addresses. This problem is called «51% Attack». This is possible theoretically, but very costly economically.

The term «blockchain» is used to refer to both a chain of blocks in one node and the entire computer network.

## Mining

Recoring a new block to the bitcoin blockchain is designed in such a way that it requires large computing resources — for time-consuming mathematical calculations. This is done on purpose to increase the reliability of the system. These calculations are performed by miners — people who have provided the computing power of their computers for this purpose. They receive a certain amount for this, which is paid by the person who initiated the transaction.

GPUs on video cards handle the above calculations best of all. That is why their price, following demand, jumped so much after the popularization of bitcoins.

# Internet of Asstes

So, a system of some virtual assets, protected from unauthorized copying, was created. Satoshi «launched» bitcoins into it, because his goal was to create a cryptocurrency, but in the same way it was possible to deploy a similar blockchain (computer network) with arbitrary type of assets - company shares, social capital, bonus points. Which the participants of the assets circulation agreed among themselves. An element of information in a blockchain can represent any asset.

It was a truly qualitative breakthrough — the Internet of assets was added to the Internet of information. There was a guarantee of the authenticity of digital assets — that is, the confidence that it cannot be copied. This asset could be securely held and passed on to someone else.

The property of immutability of data in the blockchain is still far from appreciation and is not widely used. Imagine a real estate registry that can't be changed by corrupt employees. And this is a big problem not only in the third world countries.

## Cryptocurrency

However, people immediately seized on bitcoin as a cryptocurrency — that is, an analogue of ordinary money. It has become convenient for a person from one point of the globe to quickly and inexpensively send a certain amount of bitcoins to another continent. It was much more comfortable, faster, cheaper and even more reliable than a bank transfer. There appeared exchangers where fiat (ordinary) money could be exchanged for bitcoins and vice versa.

Cryptocurrencies are completely anonymous. A bitcoin wallet (which lives somewhere on the blockchain) is accessed using its private key, a string of characters. Whoever owns this key can send transfers from this wallet to other addresses. This is done with the help of special programs or websites that have implemented access to the blockchain.

At the same time, information about all addresses (wallets) and transactions in the bitcoin blockchain is publicly available. You can trace the movement of funds from wallet to wallet, and government agencies that fight, for example, against drug trafficking, use this.

However, bitcoin as a financial instrument has a serious problem — high volatility. Its exchange rate against the US dollar can fluctuate quite a lot. Therefore, it is well suited for transactions with fast deposit/withdrawal, but during long-term storage, unpleasant surprises may arise. At the same time, the volatility of bitcoin was actively used for «investing» in it in order to play on the course moves.

> During an Ask Me Anything (AMA) session on Reddit, Bill Gates was asked if he invests in digital assets. The billionaire replied that there are no cryptocurrencies in his portfolio, since he likes to invest money only in those assets that justify their value. For example, in a company that produces any product. According to Gates, digital assets cannot be called such.

## Blockchain v2.0

In 2013, Canadian Vitalik Buterin introduced a new version of the blockchain technology — Etherium, which brought some useful innovations, such as different types of assets in one blockchain (tokens). But, most importantly, it allowed, in certain cases, when conducting transactions between the parties, to remove the need for an escrow, ensuring the reliability and fairness of the deal. For example, in order to buy shares of a company, it is not necessary to contact a broker or a centralized exchange, losing on commissions and risking money. Now theoretically it is possible to do it yourself directly. The need for exchanges disappears, the need for banks, stock exchanges and other intermediaries disappears.

It was Buterin's Etherium that launched the era of smart contracts and decentralized finance (DeFi). The technology of the new blockchain, in addition to the **guarantee of the authenticity of assets** gifted by Satoshi Nakamoto, added **a guarantee of their fair circulation**.

More on this in the next article.

# Conclusions

**Blockchain allows you to put into circulation virtual elements that quite well represent assets of the human world. At the moment, the main, although far from the only asset virtualized in the blockchain, is money.**

**These elements are protected from copying (duplication), have an owner, can change it at his will. Blockchain as a system for managing these elements is well protected from both hacking and technical failure.**

**Blockchain is decentralized — no organization owns it, and no individual has virtually no ability to interfere with its work.**

**Blockchain is financially self-organized — transaction fees go to reward miners who create new nodes.**